boise idaho sales tax rate 2019

The total tax rate might be as high as 9 depending on local municipalities. Find houses and flats for sale and to rent estate agents real estate.

There are 19 that also.

. Resort cities have a choice in whats taxed and can include everything thats subject to the state sales tax. 31 rows The latest sales tax rates for cities in Idaho ID state. Chubbuck ID Sales Tax Rate.

This includes hotel liquor and sales taxes. Average Sales Tax With Local. The personal exemption was eliminated starting in the 2019 tax year just as they were with federal income taxes.

Select year Select another state. The minimum combined 2022 sales tax rate for Boise Idaho is. Non-property taxes are permitted at the local level in resort cities if a 60 percent majority vote is obtained.

Wayfair Inc affect Idaho. The Idaho sales tax rate is currently. Boise ID Sales Tax Rate.

The County sales tax rate is. Avalara WHMCs Automatically Calculate Sales and Use Tax for Transactions Invoices. Other local-level tax rates in the state of Idaho are quite complex.

Cascade - 208. 208-392-4415 whenever youre mailing address changes. An alternative sales tax rate of 6 applies in the tax region Boise which appertains to zip codes 83705 83715 and 83716.

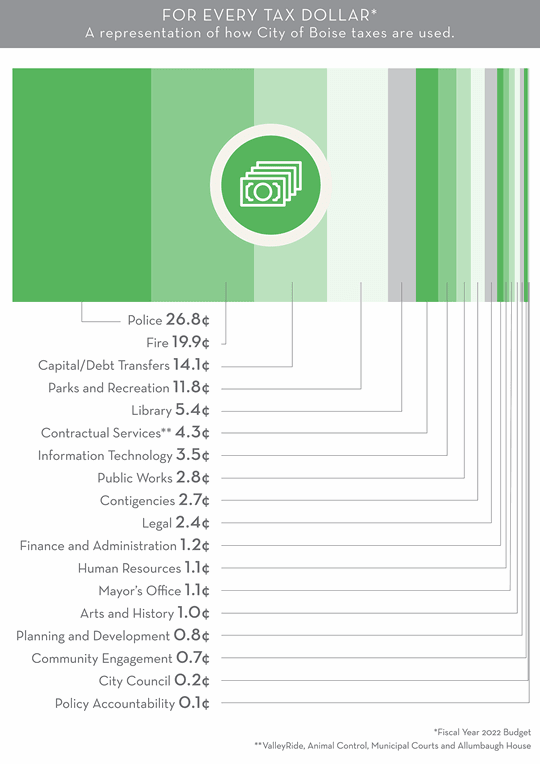

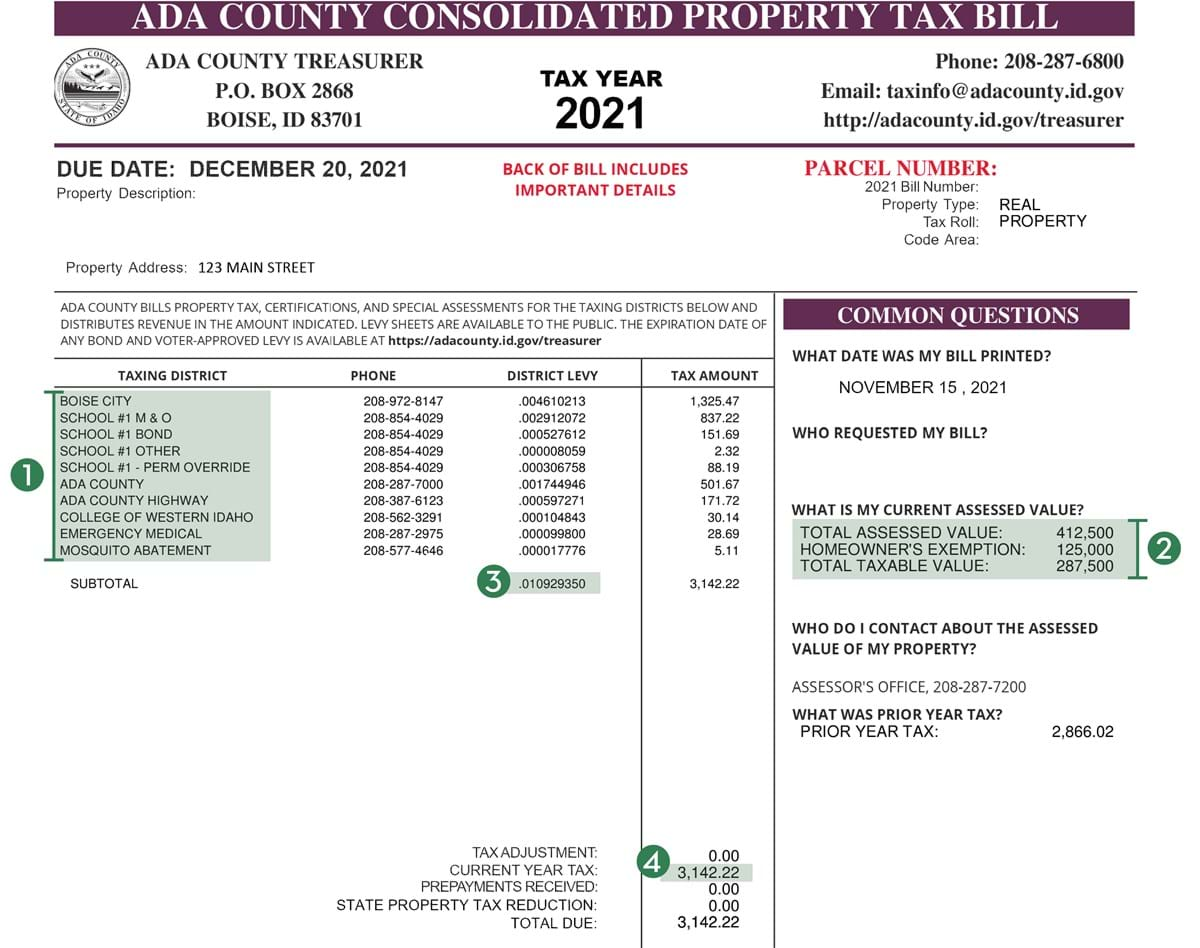

The Idaho ID state sales tax rate is currently 6 ranking 16th-highest in the US. An alternative sales tax rate of 6 applies in the tax region Ada which appertains to zip codes 83702 83709 83712 and 83713. A levy rate of 014 rounded to three decimals means you owe 14 of taxes for every 1000 of your propertys taxable value.

2020 rates included for use while preparing your income tax deduction. This rate includes any state county city and local sales taxes. Proof of payment of property Taxes is the responsibility of the Tax payer IC63-1306.

Contact the following cities directly for questions about their local sales tax. The December 2020 total local sales tax rate was also. This covers taxes on hotels booze and sales.

What is the sales tax rate in Boise Idaho. There are a total of 116 local tax jurisdictions across the state collecting an. This is the rate you will be charged in almost the entire state with a few exceptions.

This is the total of state county and city sales tax rates. Lowest sales tax 6 Highest sales tax 9 Idaho Sales Tax. Your free and reliable 2019 Idaho payroll and historical tax resource.

Depending on local municipalities the total tax rate can be as high as 9. Rates include state county and city taxes. Idaho 2019 Tax Rates.

In comparison to local-level tax rates in other states. The Boise sales tax rate is. Ad Avalara automatically calculate sales and use tax for transactions invoices and other.

Sales and property tax rates are relatively low in the state. Cities with local sales taxes. The latest sales tax rate for Boise ID.

Depending on local municipalities the total tax rate can be as high as 9. Idahos state sales tax is 6. Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3.

The average local rate is 003. Coeur dAlene ID Sales. The current total local sales tax rate in Boise ID is 6000.

There are approximately 186450 people living in the Boise area. 7 days ago The median property tax in Boise County Idaho is 1044 per year for a home worth the median value of 186700. The average combined tax rate is 603 ranking 37th in the.

Be sure to keep accurate records receipts and cancelled checks documenting your payment. Boise ID Sales Tax Rate. Caldwell ID Sales Tax Rate.

Did South Dakota v. 2022 List of Idaho Local Sales Tax Rates. Idaho new hire online reporting.

Local level non-property taxes are allowed within resort cities if approved by 60 majority vote. Get Boise Property Tax Rate. Be sure to notify the Assessors Office at.

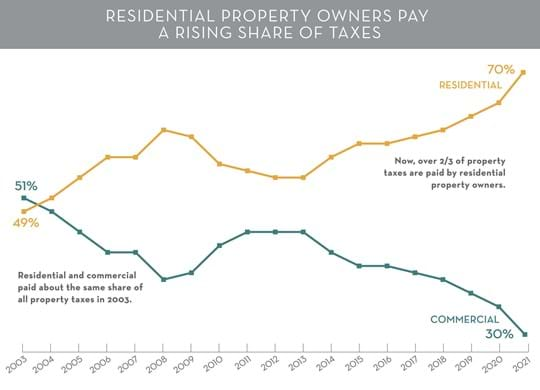

This is how your levy rate is determined. Burley ID Sales Tax Rate. Levy rates for 2019 in Boise were at their lowest levels in at least 10 years.

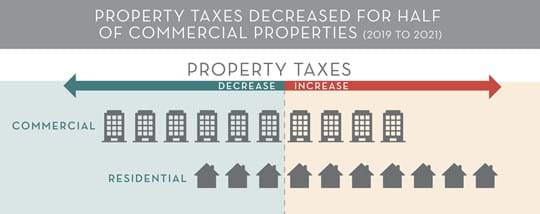

We used 2019-2021 to take out the impact of the Governors Public Safety Grant Initiative which gave. The Idaho ID state sales tax rate is currently 6. 2020 rates included for use while preparing your income tax deduction.

The current state sales tax rate in Idaho ID is 6. Some but not all choose to limit the local sales tax to lodging alcohol by the drink and restaurant food.

Settled Tax Problems In Idaho 20 20 Tax Resolution

Settled Tax Problems In Idaho 20 20 Tax Resolution

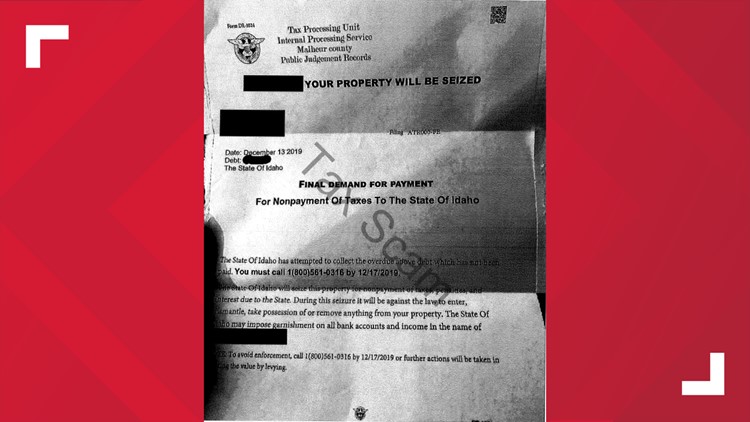

Idaho Tax Commission Renews Warning About Fraudulent Mailings Ktvb Com

Idaho Sales Tax Guide And Calculator 2022 Taxjar

Boise Idaho Id Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

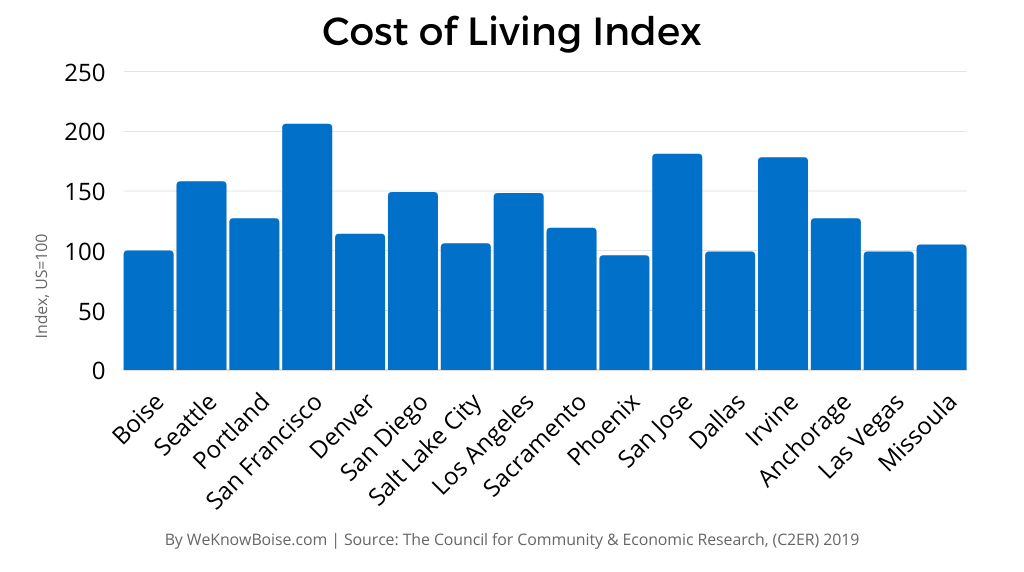

What S The True Cost Of Living In Boise Id

December 2019 Market Report Boise Regional Realtors

Settled Tax Problems In Idaho 20 20 Tax Resolution

Idaho S Grocery Sales Tax Is An Issue At Every Legislative Session Have Thoughts Let S Talk Idaho Capital Sun

Explain This To Me How Idea To Cut Most Homeowner Property Tax And Increase Sales Tax Would Work

Idaho Property Taxes Everything You Need To Know